Rep. Jeff Van Drew, RN.J., discusses Biden’s Build Back Better agenda, which is fighting in the Senate and midterm elections in 2022.

A number suggested taxes targeting ultra-wealthy Americans and affluent corporations suffered a potentially fatal blow on Sunday, putting a key pillar in President Biden’s sweep. economic agenda.

Moderate Democratic Senator Joe Manchin told Fox News Sunday that after more than five months of back-and-forth negotiations with the White House and other Democratic leaders, he could not support the $ 1.7 trillion final package.

“I can not vote to continue with this piece of legislation,” the West Virginia senator said during the interview, citing concerns about the hottest inflation in decades. “I just can not. I have tried everything humanly possible.”

BIDEN PITCHES RENEWED MILLIONAIRE TAX, GLOBAL MINIMUM FOR FINANCING OF USE BILL

Late. Joe Manchin, DW.Va., walks the grounds of the White House on November 18, 2021 in Washington, DC (BRENDAN SMIALOWSKI / AFP via Getty Images / Getty Images)

Manchin’s opposition, however, brings the various tax increases included in the massive social spending and climate bill, as well as democratic efforts to extend the boosted child tax deduction and abolish a Trump-era limit on state and local tax deductions. Democrats had previously hailed the expanded tax deduction for children as a successful way to reduce poverty with direct payments to low-income families, hoping to trust that message (“Money in people’s pockets and shots in people’s arms”) long before the 2022 midterm elections.

New taxes that have been pushed out indefinitely include a minimum of 15% on companies based on profits they report to shareholders, a tax that would only apply to companies that reported over $ 1 billion in revenue in three years in a row. Senate Democrats estimated the tax would apply to about 200 companies. The “Build Back Better” framework also included a global minimum tax of 15%, which would apply to corporate overseas earnings.

Another tax that has been shelved for now is a proposed 1% surcharge on share buybacks that was designed to deter companies from repurchasing their own. stock from investors and encourage companies to spend this money on long-term investments, such as hiring and wage increases.

Share repurchases have become a frequent target for two parties on Capitol Hill in recent years, as companies use capital to reduce the number of outstanding shares by reabsorbing them, thereby increasing earnings per share. share in the company instead of growing the company or bringing it back to employees.

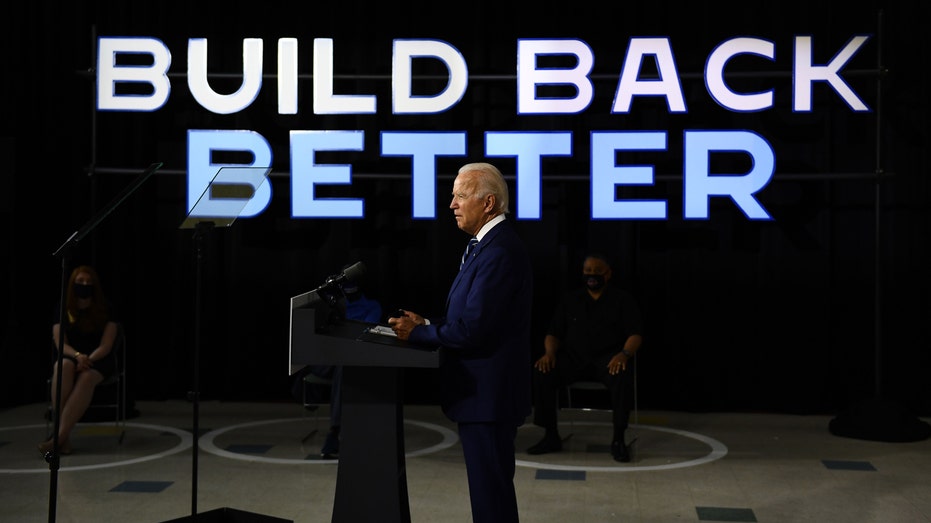

Then-presidential candidate Joe Biden talks about on the third plank of his Build Back Better economic recovery plan for working families, on July 21, 2020, in New Castle, Delaware. (BRENDAN SMIALOWSKI / AFP via Getty Images / Getty Images)

Biden had also called for an additional tax on multimillionaires and billionaires, setting a 5% rate on people with incomes in excess of $ 10 million. This rate would increase to 8% for people with an income above $ 25 million – in addition to the current highest income tax rate of 37%. The White House estimated that it would affect about 0.02% of taxpayers.

Other provisions of the bill aimed at wealthy taxpayers included an attempt to close a loophole that allowed some wealthy Americans to avoid paying 3.8% Medicare additional tax on their earnings by strengthening a net investment income tax for all , earning more than $ 400,000.

Manchin’s objection also rejected the Democrats’ push to strengthen tax enforcement by giving the IRS $ 80 billion in additional funding to crack down on tax evaders.

Democrats responded to Manchin’s stunning withdrawal from the negotiations with contempt and promises to continue to push for the passage of the bill.

Late. Ron Wyden, D-Ore., On February 12, 2020 in Washington, DC (Sarah Silbiger / Getty Images / Getty Images)

“Failure is not an option here,” said Senator Ron Wyden, chairman of the Senate Finance Committee. “A package that addresses critical long-term priorities, such as providing families with financial security, lowering health care and prescription drugs for seniors and creating jobs in clean energy by fighting the climate crisis, would go a long way towards solving our challenges. . “

Biden had already diluted most of its proposed tax cuts to reassure Senator Kyrsten Sinema, D-Ariz., Who criticized the sharp rises in corporation taxes, capital gains taxes and income taxes. The entire signature of former President Trump from the 2017 tax law, which lowered rates significantly for businesses and affluent Americans, is likely to remain intact.

GET FOX BUSINESS ON THE WAY BY CLICKING HERE

If Biden had succeeded in passing the proposal, Congress would have approved a staggering $ 5 trillion in spending in less than a year since he took office, an unprecedented level. The nation’s debt level is already at a historic high of $ 29 trillion and is about to exceed $ 30 trillion.

Post a Comment